Boyden Report Series

Decoding Tech Trends and Leadership in the Digital Age

Technology Report 2024: Analyzing markets, studies, and trends reshaping business with expert insights from Boyden's Global Technology Practice Members

Decoding Digital Transformation

Cybersecurity: CISO in the Spotlight

“The role of chief information security officer has risen in strategic importance more than any other role in the last decade and is often involved in all levels of business planning and strategic decision-making. Every CISO should be part of the top executive team and if the CISO sits on the management board their effectiveness is much higher. The most effective CISO is someone with a risk or compliance background. This is a pivotal role today and identifying and recruiting the right expertise requires a forensic knowledge and understanding of the talent pool and how it is evolving.”

Andreas Landgrebe

Managing Partner, Austria, Romania, Slovenia and Slovakia

Global Sector Leader, Digital Transformation Leadership

- The increasing number and sophistication of cyber threats have made cybersecurity a top priority for individuals, businesses, and governments.

- At the government level, cybercrime threatens national security and global economic stability. Damages from cybercrime are estimated at US$8 trillion for 2023, and it is projected to cost the world economy US$10.5 trillion annually by 2025.

- Organizations are focusing on various solutions. Gartner predicts that by 2026, companies prioritizing security investments through continuous threat exposure management will see a two-thirds reduction in breaches. To address threats like malware, ransomware, phishing, insider threats, and DDoS attacks, companies focus on critical infrastructure, network, endpoint, application, cloud, information, and mobile security.

- Key cybersecurity technologies and practices include security awareness training, identity and access management (IAM) with multi-factor authentication, attack surface management, and disaster recovery with remote backup. AI-driven technologies are increasingly used for real-time attack identification and response, incorporating tools like SIEM, SOAR, and EDR.

- Strategic, human-centric approaches to security use GenAI to augment human endeavours, implementing a ‘contextually appropriate’ security behaviour and culture program. By 2025, 40% of cybersecurity programs will deploy socio-behavioural principles, such as nudge technologies, to influence security culture, 8x the amount deployed in 2021.

- In turn, GenAI is expected to need greater cybersecurity resources to secure it, prompting a projected 15% incremental spend on security.

- Its strategic importance has made cybersecurity a boardroom priority; 28% of board directors, chairs or NEDs cite the need to strengthen cybersecurity skills in their organisation. At board level, stronger cyber skills are a top three priority.

- While training will play an important role in building these skills, for many leaders it’s really about a mindset shift, knowing when and how to ask the right questions. Leaders don’t need to be cybersecurity experts, but they do need to keep informed and consider cybersecurity implications in each key business decision that they make.

- A snapshot on cybersecurity readiness: Belgium, Lithuania, and Estonia lead, with 14 out of the top 15 spots held by European nations. The US ranks lower with a score of 64.94, facing challenges in achieving comprehensive coverage. The top three countries in market value for the national cybersecurity industry are the United States, China, and the United Kingdom. The US market value is expected to reach US$117 billion by 2028, with China projected at nearly US$41 billion.

- For organizational readiness, structure is key. Cisco research finds that 47% of CISOs report directly to the CEO. This direct reporting line, most prevalent in the US, results in fewer breaches, better funding, and increased cybersecurity awareness among employees.

- The primary value of a CISO lies in assessing realistic risk scenarios and selecting effective safeguards. An effective CISO balances operational needs with cost-benefit considerations.

- More broadly, cyber talent is a major concern. With a global shortage of 3.4 million cyber professionals, the World Economic Forum has convened a special Centre for Cybersecurity, promoting solutions such as building organisational resilience through cyber skills and upskilling or reskilling talent.

- Read more on the topic:

IMB: What is cybersecurity?

Cybercrime Magazine: Cyberwarfare in the C-Suite

International Monetary Fund: IMF Cyber Risk: a growing concern for macrofinancial stability

Sosafe: Cybercrime trends 2024

Gartner: Top trends in cybersecurity for 2024

Boyden Global Executive Survey: Exploring adaptivity through strategy and talent

Express VPN: Cybersecurity spending: how much are countries investing in their digital defences?

World Economic Forum: Bridging the cyber skills gap

A New Symbiosis for Fintechs and Banks

“Banks and fintech’s have moved from competing into a partnership relationship. This collaboration is opening new opportunities for the benefit of both, integrating cost-effective solutions into existing infrastructures, making financial services more affordable and attractive, thus more inclusive.”

Lourdes Lopez

Partner, Spain

Global Sector Leader, Fintech

- In banking, fintech has morphed from disruptor to companion, with banks becoming B2B fintech’s primary source of revenue. Consumers are wrapping fintech functionality around their bank accounts, while banks are wrapping microservices around their core systems and integrating fintech partners via application programming interfaces (APIs).

- Banks want a bigger play in fintech. Bloomberg Intelligence shows that US banks are at the forefront of global spending on fintech, the majority of which is directed to B2B start-ups, which the banks can leverage themselves.

- Thus, the lines between banks and fintechs are blurring: in 2020 UBS launched a venture fund to target fintechs months after naming ING Groep NV’s Ralph Hamers, an outspoken champion of digital banking, successor to CEO Sergio Ermotti. There are a lot more verticals for new fintech companies and some of these are highly dependent on banking partnerships.

- All this is changing the cultural dynamic and driving a new ecosystem where specialist providers share expertise and platforms with both emerging fintech companies and established banks; these different entities use the same infrastructure to fraud check every customer throughout their lifecycle. Such partnerships weaken the ‘anti-bank’ narrative.

- For fintechs, banks are therefore no longer the enemy. The reality is that fintechs and banks are, broadly, interdependent, working more as collaborators and less as rivals.

- This will double down as traditional banks face the challenge of adaptability to remain relevant. GenAI projects in the fintech sector focus on improving operational efficiencies and enhancing the customer experience. The next generation of fintech platforms will significantly integrate GenAI, marking a transformative shift to the entire financial services sector.

- GenAI will become a co-pilot for security experts, flagging inconsistencies and preventing crime, which will make fintech platforms safer. Secondly, AI in fintech platforms will challenge how traditional legacy banks assign credit, revolutionising the concept of credit underwriting by analysing reams of data and determining more about an applicant’s credit request than ever before. Sophisticated credit scoring will shift credit decisions from person-specific to transaction-specific.

- Overall, fintech has brought huge benefits to banks, customers, and financial regulation. In the process, fintech providers have become a key part of the corporate social responsibility landscape (CSR) by enabling efficient digital payments, limiting financial exclusion, facilitating more effective crowdfunding and lowering operational costs.

- Read more on the topic:

Sifted: Fintech big bank culture wars

Fintech Magazine: Fintech at its finest: adding value with innovation

Teknospire: Corporate social responsibility and the impact of fintech

Managing Change and Disruption in Digital Transformation

“Digital transformation should be treated as a journey, not a project. This means that while leaders must start with a clear vision for the future, they need to also demonstrate focus and stamina to stay the course, agility to adapt to changing circumstances, and bravery to be authentic and transparent with their teams about the risks and the opportunities that lie ahead.”

Paul Dennis

Partner, U.S.

- The word ‘digital’ means different things to different people but there is a consensus around the elements of digital transformation: customer experience; operational agility; culture and leadership; workforce enablement and digital technology integration.

- Jim Swanson, CIO of Johnson & Johnson focuses on customer-centricity. “We talk about automating operations, about people and about new business models. Wrapped inside those topics are data analytics, technologies, and software – all of which are enablers, not drivers... In the centre of it all is leadership and culture... if [this] is not at the heart, [digital transformation] fails”.

- The EIU highlights three challenges today for digital transformation: security, integration, and talent.

- Cybersecurity issues are well recognised; it’s now easier and cheaper to attack through multiple vectors on an organisation’s attack surface.

- Integrating new technology with legacy systems is the top challenge impacting AI initiatives according to Altair, a US-based IT company. They found 40% of companies had wasted money in the year to mid-2023 due to the failure of one of their AI projects.

- Digital transformation must be human-centric; finding the right talent, on-going digital literacy and change management are mission-critical. This shines a light on culture and the need for alignment between managers and teams for successful digital transformation.

- The pandemic accelerated digitalisation and after a surge in IT spending in 2020, another uptick is expected in 2024 to implement GenAI solutions to boost efficiency, cut costs and access new customers.

- With concerns over jobs, most organisations face some resistance to internal adoption; a study by Forrester found that 56% of respondents agree that ‘the willingness of internal teams to adopt and use new technology’ was very challenging or challenging.

- In organisational change, an early majority will follow the lead of early adopters as long as they see evidence of progress. The Chartered Institute of Personnel Development (CIPD) in the UK found that more than 80% of employees didn’t think that increased technology had improved business performance. And only 35% of employees had been consulted on the introduction of new technology.

- A strong communications strategy is essential. According to McKinsey, transformation is 5.8x more likely to be successfully at organisations where CEOs communicate a compelling, high level change story.

- Digital leadership is in the spotlight, and it doesn’t stop with the CEO. Boyden’s global talent study finds that digital skills are the most important capabilities to be strengthened at board level. In digital transformation, no-one can be left behind.

-

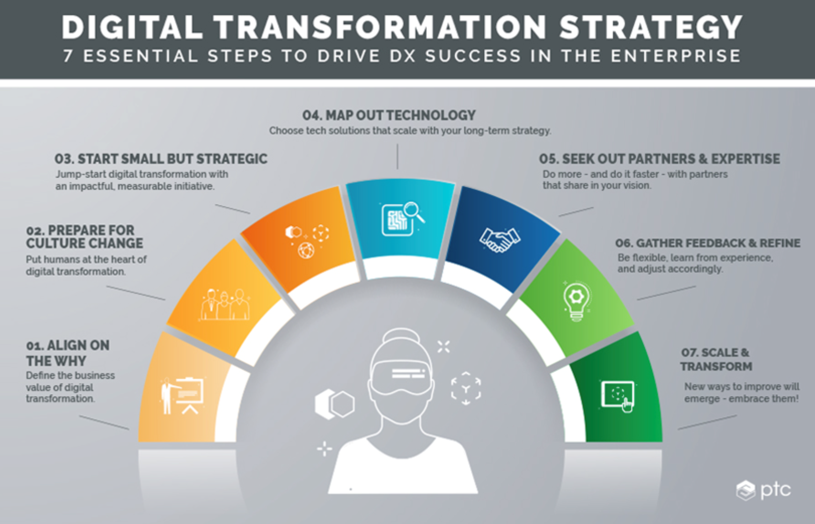

Software development company PTC offers a framework for success in managing change through digital transformation strategy:

- Read more on the topic:

EIU: The Three Challenges of Digital Transformation

The Enterprisers Project: What is Digital Transformation?

Nautical Commerce: Forrester: From Marketplace to Market Share

Appraisd: Addressing the Challenges of Digital Transformation

Boyden Global Executive Survey: Exploring adaptivity through strategy and talent

PTC: 7 Key Principles of Digital Transformation Strategy

Quick links to next sections of Boyden Technology Report:

> Section 3: Technologies on the Horizon

> Section 4: Talent Trends and Leadership Solution in a Digital Age