This edition explores private equity industry trends, focusing on challenges facing industrial portfolio companies.

Introduction

In the Golden Age of private equity, the industry is prospering, due in part to the low cost of capital, an overall healthy economy, and a growing middle market. New firms are opening and growing at a rapid pace, with over $3 trillion in funds raised during the past five years.1 And yet, investment in industrial portfolio companies has suddenly entered more complicated and challenging times.

In this edition of Executive Monitor, Boyden will explore overarching trends in private equity, with a special focus on areas of opportunity, hurdles and disruption within the industrial sector, including manufacturing, energy, automotive, transportation, logistics and other industries. The report is based on in-depth interviews with Boyden partners and senior executives from private equity firms and portfolio companies in the U.S. and Europe, as well as secondary research.

Shifting Investment and Exit Cycles

While the private equity industry continues to make deals, find exits and raise capital, many believe that exit cycles are expanding, as it is taking longer to optimize performance and realize the full transformation potential of investments. “The market is demanding high PE multiples over the last few years, as compared with 10 years ago,” observes Conor Boden, an Advisor with Advent International. “It wasn’t easy then, but it’s become tougher now.”

According to McKinsey, successful exits are becoming far more complex. The past four years saw over 2,000 exits, with the global value of PE exits surpassing $500 billion per year. As the sheer number of deals increases, management teams must think far more critically about how to successfully complete their investment cycles.

“You need to find the right window of opportunity for a value-maximizing exit,” asserts Burkhard

v. Wangenheim, a Partner with Munich-based private equity firm AFINUM. “If you miss that window of opportunity, firms may need to be prepared to wait for another four to five years.”

Danny Weingeist

Managing Partner

Kayne Anderson

Whether a private equity fund sees a short- or long-term cycle is partly dependent on sector. Energy exploration & production (E&P) and automotive, for example, are generally seeing longer investment cycles. “We often have a longer hold. Ours is typically six to eight years versus a typical private equity hold that used to be three to four years,” says Danny Weingeist, a Managing Partner with Kayne Anderson Energy Funds, which focuses on upstream oil & gas.

According to Francesca D’Arcangeli, Global Leader of Boyden’s Industrial Practice and a Managing Partner of Boyden United Kingdom, in some cases it depends on the size of the asset base. “The greater the capital investment and the size of balance sheets that are the asset base, the longer the cycle needs to be,” she says.

Paul McDermott

Managing Partner,

Cadent Energy Partners

The industry in which a business operates can also greatly affect the outcome of exit cycles. For example, energy is seeing increasingly difficult exits and poor returns. As Paul McDermott, Managing Partner of Cadent Energy Partners in Houston cites, “Many of the major institutions, such as the large endowments and foundations, have soured on the sector for ESG reasons and its high beta nature. With little new capital coming into the area, portfolio exits have been difficult. The result is poor performance that confirms justification for no new money, and it becomes a downward spiral. However, for the people that do have money, the opportunities can be quite good in this environment.”

A firm’s exit strategy for its portfolio companies is critical when looking for new leadership talent. Tom Zay, a Managing Partner of Boyden United States in Houston, notes that “the CEO profile changes based on the exit strategy. If you’ve got a short-term exit strategy, you’re looking for a different type of CEO than if you have a five- to seven-year exit strategy.”

Trying Times for Automotive and Energy

Many private equity investments in the industrial sector, notably automotive and energy, have hit challenging times as firms diversify their portfolios away from these industries and business models evolve. A global oil & gas glut, U.S. shale and historically lower prices have dramatically reduced the value of E&P concerns. In automotive, sales are notably reversing following the halcyon days of recent times. The industry-wide shift to electric vehicles is playing a role.

Jeff Hibbeler

CEO, SPL Inc.

Jeff Hibbeler, CEO of SPL Inc., says that while private equity deals are difficult on the oil & gas side, opportunity remains for larger operators to buy at optimal prices. “We had our mega downturn in 2015-2016 and then we bounced back in 2017-2019. But 2019 doesn’t look great for the smaller and medium-sized operators. I think a lot of people got ahead of their skis. It is a buyer’s market, particularly in E&P. I think you’ll see some massive deals soon, in the Permian Basin, for example, with some of the supermajors buying up some of the big independents. It’s no longer about price; it’s all about how your business operates.”

Lackluster performance in E&P is precipitating a downturn in investor sentiment. “I think it’s easy to blame it on fossil fuels and climate change when returns have not been adequate – and returns have not been adequate, not just on the public side, but also on the private equity side,” says Danny Weingeist, Managing Partner of Kayne Anderson. “I think if you look through track records, they’re not very compelling. So, I think investors are now saying, ‘You know what? I’m going to invest less.’ As a result there’s really no capital markets available for the public, meaning there’s no debt or equity they can go raise. It’s the worst environment for private equity that I’ve seen in a while,” he adds, in reference to E&P.

“Though we’ve been successful with our most recent fund, it’s a tough time investing in the hydrocarbon energy space. We’ve had success starting companies by being very selective with the sector in which to make the investment and choosing the right management teams to work with.”

– Paul McDermott, Managing Partner, Cadent Energy Partners

Laurent Michaux, former Vice President Strategy & Business Development at Novares, a French automotive parts manufacturer, characterizes the automotive sector’s challenge as more sudden and recent. “Since the beginning of 2019, the automotive market is becoming increasingly difficult throughout the world,” he explains. “This means buyers will be much more courageous and sellers will have less opportunity to sell and may now have pressure to keep their portfolio company for a longer period.”

Laurent Michaux

Former Vice President

Strategy & Business Development

Novares

A key fallout in the auto sector is evident in financing. “Bankers and investors become hesitant to support automotive supply manufacturers in general” says AFINUM’s Wangenheim. “Much of the shift is connected to the rise of e-engines and electric vehicles.”

Michaux points to a more concerning long-term test for the auto sector. “Young people today care about smartphones, communication and travel, and they really don’t care anymore about cars. This means the car will go from an emotional product to a rational “tool to move”. When your product has a risk to become a commodity, it’s a very important change.”

Management in Private Equity

Executive Leadership

Private equity managers with the confidence to lead a company and the ambition to achieve business objectives are critical to the success of a private equity firm. Equally important, on both the PE firm and portfolio sides, are industry expertise, interpersonal skills, and a willingness to collaborate and learn. Stephan Franken, Partner at Boyden Germany, expresses the need for smart, flexible people and sees a trend forming of employees, regardless of age, wanting to “change the industry and move the needle.”

“Because of the IoT and digitization, it’s more important that people are open-minded toward working with new technology and willing to learn every day,” adds Christoph Spors, Investment Director at Capiton AG.

John Hussa

President, Viance

This willingness to learn extends beyond the C-suite, calling on executives to think globally. John Hussa, President at U.S.-based wood treatment chemical company Viance and a former senior executive within the manufacturing and chemical sectors in Europe, emphasizes the value of managers who are able to fully embrace the cultures in which the firm operates, saying: “In terms of leadership, absolutely the understanding of cultures and languages is critical, especially when working with European unions and work councils.”

Research shows that private equity firms are also embracing more non-traditional backgrounds outside of the finance world in order to build teams with deep industry expertise. According to Norbert Eisenberg, a Managing Partner at Boyden Germany, “Financial experience is less important and will become of even lesser importance than the industry know-how. The good private equity firms are aware of that, both in integrating people with a management background into their teams, and in positioning the right talent in their portfolio companies with each deal.”

“Some PE houses invest in the team and the people as much as the product, and others are just interested in what the business has to offer with their technology, product, sales portfolio or market placement. Each firm has a different strategy.”

– Claire Lauder, Global Co-Leader of Boyden’s Industrial Manufacturing Practice and Partner, Boyden United Kingdom

However, Jeff Hibbeler, CEO of SPL Inc., a global oil analytics provider based in Houston, doesn’t see private equity firms and their portfolios keeping pace. “You’ve got to have technology. You have to have a great CFO. You need a wonderful salesperson. And you need a CEO that’s got a vision. If you check all those boxes, you’re in great shape,” he asserts. “I would argue though, most PE-backed companies do not have all four of those boxes checked. That’s where you see problematic outcomes. There’s either too much of a technology slant, too much of a finance slant, too much of a sales slant. You really have to have talents in those four positions.”

Hibbeler finds that in the industrial sector, the executive VP or lead sales executive – that person who, as he describes, is “not only a natural salesperson and a rainmaker, but can manage other people, manage a CRM, and build a pipeline” – is by far the most difficult to land. “They also need the ability to build out a three- or five-year sales pipeline. That’s tough to find and you can’t just look at a resume,” he adds.

A Holistic Approach

As private equity firms look to bring in new talent, several on Boyden’s expert panel suggest a much more holistic approach. This ensures that the PE firms themselves and their portfolios employ industry experts with a wide breadth of knowledge. While it is tempting to assume the success of private equity firms relies heavily on smart financing and investments, top players in the space overwhelmingly point to people over process.

John Mapes

Partner, Aurora Capital Partners

“Strategy and procedure are important, but if any of these organizations don’t have the right people, they’re not going to win,” says John Mapes, Partner at Aurora Capital Partners. “The older I get, the more I realize that if it’s Aurora, the New England Patriots, or one of our portfolios, it all comes down to people.”

Studies agree; a report by Summit Leadership states that addressing human capital and organizational needs with effective planning and rigor shows higher returns for all investors in private equity. Without the right people, companies can expect leadership issues, talent gaps, and ineffective management teams and decision making to hinder growth and investment returns going forward.

Kayne Anderson’s Weingeist explains that diversity of skill sets is what makes a business run smoothly. “You need a good mix of operational, technical and engineering people who work well with finance guys. If you have all of one or all of the other, it’s probably not going to be very successful,” he says. Weingeist also stresses the importance of management teams that have successfully worked together in the space before. In fact, people that are aligned in sector but vary in areas of expertise create success both inside and outside the firm.

“Investors ideally like to buy management teams. This means they would rather buy a company with an intact management team that has the ability to move forward and grow. From there, they can take it to the next level with the guidance of the private equity firm.”

– Tom Zay, Managing Partner, Boyden United States

The ability to develop and maintain positive relationships with portfolio companies is also critical. “As management we always appreciated the interest and curiosity of the new owner towards the business, markets and operations,” explains Jan Gustafsson, Partner at Boyden Finland, remembering his time in a portfolio company. “A ‘good owner’ has a certain respect towards the experience of the management. On the other hand, it was always important to understand the priorities and goals of the new owner for the coming years to make our partnership a success. By fostering a respectful relationship with portfolio companies, firms will see increased revenue, more streamlined operations, and eventually, more meaningful returns.”

While the focus of many firms is on the bottom line, management needs to remember that investing in top talent with diverse skill sets is one of the most critical elements to reaching business goals. Acknowledging this talent and using it to better manage relationships with portfolio companies will ultimately drive returns and revenue higher.

Further, to engage a more holistic approach, smart firms are increasingly implementing more robust in-house human resources functions. “Portfolio companies once deemed too small to have a head of HR will start implementing them. I think talent and HR chiefs will also start to pop up within more of the GPs (General Partners),” predicts Aurora’s Mapes.

Board Composition

Historically, the boards of private equity-backed companies have largely been made up of members from the firm, C-suite executives in the company, and other parties with vested interests. However, as broad market expertise becomes increasingly valued, these same boards are now bringing in credible external members with experience from peer companies and potential customer companies.

Outside board members act as watchdogs for inside directors and for the way in which the organization operates, providing guidance on corporate governance and risk management. They also help handle internal disputes between directors, or between shareholders and the board.2

“One thing that has helped the growth initiatives decisions has been that we have had a strong cash flow and we have been able to fund our growth opportunities through our own cash flow, not by injecting new equity.”

— Anders Dahlblom, Managing Director, Paroc Group

According to Boyden UK’s d’Arcangeli, “There’s lots more pressure now to have independent boards, especially when due diligence comes around when you’re looking to exit. We are seeing more independent, non-executives placed. But there’s still a tendency to have some of the members of the private equity firm. The bigger the entity, the more likely they are to be placing an independent board of directors.”

Anders Dahlblom

Managing Director

Paroc Group

No matter the size of the board or type of company, executives agree on the need for outside members. “It’s a little different for everyone. Strategic investors tend to have a large board with 12 to 18 members, whereas a PE board is more often built up of only four to six members. Even if you have a limited board, it is very useful to add one or two independent, non-executive directors to make your company as successful as possible,” adds Michaux of Novares.

Board recruitment in the portfolio companies stands out as a challenge for PE firms to find the right balance, explains Capiton’s Christoph Spors. “We are constantly discussing what is the best background for board members,” he says. “If you are looking for people who are still working in other companies, we have to consider if they have time to have a real dedication to our company. On the other hand, if you are looking for people who have already retired, then they are out of the business (on issues).”

Fund Management

Forbes estimates that half the time portfolio firms fail to achieve the returns their investors expect, it is due to the wrong leadership running the companies.3 When private equity enters a portfolio company, it is necessary to do a management assessment to make sure the team is running efficiently.

“It’s incredibly complex for firms to do a management assessment before both parties sign a deal, because the market is very competitive,” explains Anita Pouplard, Managing Partner at Boyden France. “Most PE firms don’t dare to say, before they sign the deal, that they will ask the management to go through a management assessment. But increasingly we are seeing firms do this assessment during the first 100 days, so they know exactly what the level of the management team is and what strengths and weaknesses they bring to the business.”

The main concern of private equity is to find people who are able to lead the company and have the ambition to achieve the business plan. By running an audit of the company prior to investing, and then conducting assessments, firms will fulfill the real due diligence needed to help the business thrive.

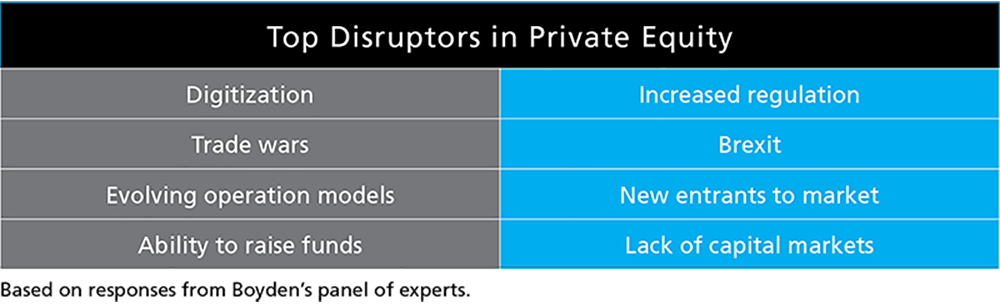

Disruption Factors

Industry leaders overwhelmingly cite digitization and technology as the biggest disruptions to private equity markets, particularly in the industrial sector. According to Boyden France’s Pouplard, industrials will be seeing increased digitization, characterized by the interconnection of products, value chains and business models. Whether it’s AI, Internet of Things, cloud or cybersecurity, enterprises are becoming more data-driven, where the insights gained from data can be actualized to streamline processes. This will be critical to optimize their productivity and efficiency and address new markets.”

Firms are moving toward technologies that drive business operations forward, including software for a myriad of operations functions. Considering the pervasiveness of these technologies, Viance’s Hussa describes digitization as “a mindset, more than anything.” In his observation, the defining factor in this transition is whether or not senior management embraces the digitization mindset. “That’s where you see the biggest effect, I think, within companies where it starts at the top.” These decisions trickle down throughout the company and impact the bottom line.

Pouplard adds that technology is disrupting boards of directors as well, noting that “companies are realizing that they not only need to have people with financial and strategic hats on the board, but they need more expertise around the table, including experts in digitization. A number of firms are creating digital strategy committees too.”

Boyden UK’s Lauder stresses the willingness to adapt to disruptive factors, saying firms that succeed in “navigating the technological changes” will make their businesses more efficient. “It will make them design and take products to market more quickly, predict demands, and make the company more competitive,” she adds.

“People think about public companies as having long-term vision. Actually, the focus is often quite short-term. Every quarter, there’s a review, and if you’re not meeting your objectives, it can be unforgiving. That’s why you see CEOs of publicly listed companies last two years, maximum. For strategic leadership this cycle is limiting, whereas in private equity, you can actually have the freedom to really drive change forward and the flexibility to do things that you would not be able to do in a publicly listed company.”

– Jan Gustafsson, Partner, Boyden Finland

A more competitive landscape is a likely outcome of the industry’s digital disruption. According to a recent Affinity Study, 46% of private equity investors believe access to meaningful data is their biggest challenge during an acquisition. Further, 44% say a lack of reliable information is the most significant factor that will cause a private equity firm to reduce its offer or walk away from a deal altogether. Data-driven firms that embrace technology and digitization and weather the disruption are likely to become leaders in the space.4

Expert View: Conor Boden, Advisor, Advent International

Based in London, Conor Boden served as Head of Portfolio Board Development at global private equity firm Advent International from 2007 to June 2019. He currently serves as an Advisor to the organization.

Conor Boden

Advisor

Advent International

What makes for a successful private equity portfolio company investment?

Boden: There are generally several types of opportunity. The first is transformational, from a strategic standpoint, where a company can look to take advantage of disruptions in the market through a strategic repositioning. The second type would be one where you see real potential to drive revenue and EBITDA growth, which could be organic or M&A-led. Third would be an opportunity to transform the company’s operational performance through improved functional capabilities, better use of technology or an increased emphasis on market development.

Of course, once you’ve done all that, what really matters is that you can not only drive that transformation, but also see some real outputs in terms of significantly enhanced company performance that will be recognized by the market. Then the market will be most likely prepared to pay you a premium on top of what you invested. But if you’re talking about making a multi-million dollar investment, you need to be looking at doubling or tripling that value or better. Then you know you’ve done a good job.

How has the investment cycle changed?

Boden: Exit cycles are largely extending. Because the industry is generally paying higher multiples than say five to 10 years ago, it’s taking longer to achieve the required returns. Now we’re all having to work harder than before with our management teams to optimize performance and realize the value creation potential of an investment. That means we’re probably having to take a bit longer and bring more resources to transform our companies, but the returns are still there to be had.

Time in private equity is always going to be of the essence, but I think one also needs to be frank about what is realistic. Your goal is ultimately to make a better company. We ask companies to be in better shape on exit than when we invested in them. That means you can’t take a short-term approach to their transformation. You need to understand what the longer-term play is going to be, even post-investment, so that the company is set up to thrive way beyond your ownership.

What is the best formula for management success with portfolio companies?

Boden: This is a big question. It’s critical to identify and work with a management team and board that’s going to be 100% focused on achieving the value creation plan. It’s understanding what the key value drivers are in that plan, then working with a team that really focuses on those key drivers without getting distracted by all the non-value adding issues that can crop up. Second is the delivery of that value creation plan. The best management teams are those that can execute at pace and accelerate the transformation of the company in terms of its performance. Setting challenging targets is critical, but it’s also important to incentivize management to deliver them and make sure you have relevant reporting and tracking tools. Third, it is important to be able to support management with the additional resources that the transformation and growth agenda require. Sometimes you need to over-invest in certain areas to achieve the outsized earnings growth that the PE model demands.

What are the “must-haves” for monitoring performance?

Boden: Apart from the more typical milestones and reporting and tracking tools, the HR department is increasingly important. If I look at where private equity was five to 10 years ago versus where it is now, a private equity investor back then would typically have said ‘We’ve got the CEO and the chairman, and perhaps the CFO in place, and that’s job done in terms of key hires.’ Now, increasingly we are focused on the HR leader too, and looking for them to be much more strategic in the role they are playing in supporting the delivery of the value creation plan. We are looking for them to ensure a much greater focus on proper objective-setting and performance monitoring throughout the organization while also ensuring that we take all the employees with us on the transformation journey through better internal communications.

How do firms attract and retain the right talent in their portfolio concerns?

Boden: Management team members and employees want to partner with a firm that is going to be in sympathy with what they want to achieve and that gets their industry. They want a partner that is as ambitious as they are, and will bring resources to help them be even more successful. It’s important that we can demonstrate empathy with what they’re about. We must not purely come across as financial investors. Those firms which convey a strong empathy with the strategic and operational challenges their portfolio companies and management teams face will be the firms that are most effective.

Conclusion

While there is little agreement on what the future of private equity will hold, there is consensus among leaders who anticipate a shift in the types of companies in which private equity firms invest. They are beginning to turn away from more traditional considerations and weigh new criteria for what makes an investment desirable.

“The good private equity firms that invest now really look for the undetected jewels that have a potential that they see, and that others may not see,” says Aurora’s Mapes.

To make these decisions, talent selection will increasingly become a key differentiator. Because things are changing so quickly, companies now need a CEO who will be able to surround themselves with the right team, possessing the right level of expertise in a setting that is much more collaborative than private equity once was.

“There is an increased importance on not just the management talent and management capability, but the whole talent pipeline internally,” according to Boyden Finland’s Gustafsson. “It speeds up the potential changes, which are very important if the relatively short ownership period is set. It also gives a signal to the whole organization that the quality of the management is important for the new owner, and that the management should give their best shot.”

Sources:

1 https://www.summitleadership.com/the-rise-of-human-capital-in-private-equity/

2 https://www.forbes.com/sites/allbusiness/2014/08/26/outside-board-members-bring-needed-experience-and-perspective-to-your-company/#300127a29198

3 https://www.forbes.com/sites/forbescoachescouncil/2017/02/24/private-equity-leadership-lessons-how-ceos-limit-company-performance/#3bd4131f2e5e

4 https://www.affinity.co/blog/private-equity-firms-use-technology