Exploring talent and growth roadblocks across Canada's CPG landscape

The consumer-packaged goods (CPG) industry has historically been a top contributor to Canadian jobs and to the Canadian economy. In recent decades, consolidation and the perception of Canada as an extension of the U.S. by multinationals have reduced the country’s head office count. More recently, increasing costs and heavy regulation have further challenged domestic growth and innovation in the sector. The COVID-19 pandemic has amplified these trends. While the bigger picture may be discouraging, a look at the executive ranks of CPG organizations suggests that, with a focus on innovative and diverse leadership, there may still be untapped market potential and plenty of room to grow.

The most current statistics illustrate that the CPG industry has grown to become the largest manufacturing employer in Canada, with 300,000 jobs across the country, accounting for more manufacturing jobs than the automotive and aerospace industries combined. By 2017, the CPG sector contributed nearly $30 billion to Canada’s GDP, and by 2018, the value of exports had grown to $36 billion, extending to more than 190 countries worldwide. Importantly, the sector also purchased 40% of Canada’s agricultural production.

Despite this profound contribution to the economy, the CPG industry in Canada has been struggling over the last few years, and many worry about its sustainability. A recent study commissioned by Food, Health & Consumer Products of Canada, an organization representing a significant portion of CPG manufacturers, looked at the industry’s underperformance across a number of areas. Modest growth in revenue and profits, increasing costs and trade spend, shifts in the employment landscape, and limited Canadian innovation have resulted in the industry growing at a slower pace than the Canadian economy as a whole.

The same cannot be said for the industry’s trajectory in other geographic markets, particularly the developing world. Product innovation is driving growth on a global scale – just not here.

ROOM TO GROW

The good news in the study is that there is potential. We have foundational strengths here in Canada. Thanks to ample arable land and water and growing global demand, the food sector alone has the potential to contribute more significantly to Canada’s GDP if it can overcome challenges presented by exchange rates and rising costs.

A closer look at the organizations that make up the sector shows there may be other reasons for hope.

In late 2020, Boyden Executive Search studied the profiles of the most senior executives leading more than 100 food, health and consumer goods organizations. The companies represent a wide range of sizes and revenues, from the likes of Hawkins Cheezies to McCain Foods and Coca-Cola. Sixty percent of the CEOs* in the study are leading the Canadian subsidiary of a global multinational that manufactures and distributes in Canada and 40% are leading made-in-Canada firms.

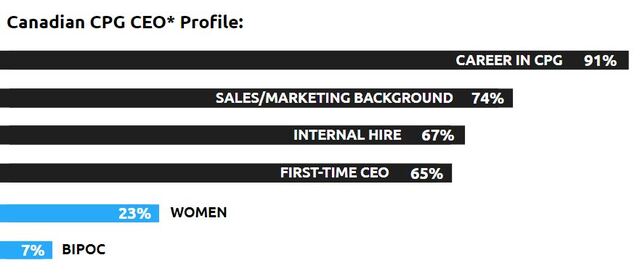

The study revealed that the profiles of these CEOs are surprisingly similar: 65% are first-time CEOs, in the role for less than five years on average; 67% are internal hires; and 74% have sales and/or marketing as their primary functional experience. A whopping 91% have spent the vast majority of their career in CPG. Only 23% of the CEOs in the sector are women, many either founders or family members. Even more striking is that, in the CEO ranks, only 7% are black, Indigenous and people of color (BIPOC).

This data paints a picture of an industry lacking in diversity, in every sense of the word. While the maturity of the sector speaks for itself, it may also go without saying that a homogenous leadership profile, combined with increasing consolidation and the prevalence of multinational organizations in the sector may be limiting growth and innovation.

A RECIPE FOR RISK AVERSION

It is no secret that large organizations can become complacent in the glow of success and begin to lag in innovation. Consistent success often breeds risk-averse behaviour. If a leadership team isn’t careful, the pressures of shareholders can bleed right through to the front line and entrench a “don’t mess with what’s working” mentality, which slows change to a snail’s pace. It is important to recognize that there is no easy solution. Investing in an innovation function doesn’t mean an organization is actually innovating. XEROX, Blackberry and Solyndra may be the lore for this lesson, but they are certainly not alone.

Given the concentration of large multinationals in the Canadian CPG space, this anti-innovation trend could easily escalate. Add to that the characteristics that dominate leadership across the sector, and you have a perfect recipe for risk aversion.

While the prevalence of first-time CEOs in the sector is in many ways a bonus in terms of injecting fresh energy and ambition, it also means these leaders are unlikely to be highly confident in the face of change. Stakeholder pressure, expectations around financial metrics, and new accountabilities for enterprise-wide decision making don’t always leave innovation high on a fresh CEO’s agenda.

At the same time, we see that the bulk of CEOs in Canada’s CPG sector are internal hires; they rose through the ranks in the company and haven’t seen much of the world outside their niche. Historical company and industry knowledge are important and valued assets, but they may not inject the thinking required for innovation that frequently comes from the fresh eyes of an external hire.

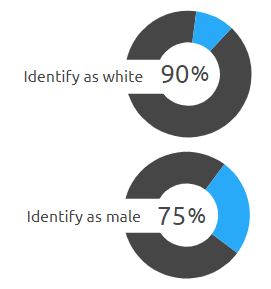

Most profoundly lacking, however, is diversity of functional experience and perspective. Three-quarters of the CEOs have sales and/or marketing as their primary functional experience. Layer on the fact that 90% of CEOs in the sector identify as white and 75% as male and the picture of a homogeneous leadership profile becomes quite clear. It’s easy to imagine how innovation and creativity could be squelched in this environment.

The good news is that there is an opportunity for Canadian CPG organizations to differentiate – and it starts with a focus on leadership.

A FOCUS ON LEADERSHIP

Build succession planning into your thinking

While these findings might be concerning, the remedy is not to send the leaders of Canada’s CPG industry packing. The most important takeaway: Now is the time to begin planning for tomorrow’s leadership team. Unfortunately, succession planning is a frequent back-burner item and often the alarm goes off a little too late. If you want to make big change, starting now, begin planning for your future team.

Building a talent pipeline, developing and challenging star employees from new areas, and networking outside of the industry will help ensure that seats aren’t left empty for long. Taking a new view of these objectives – seeing them as a way to pursue and eventually recruit new DNA – will support the financial health of your organization and contribute to the sustainability of the sector.

Bring diversity to the table

The stats are there. There is no debate. Increasing the diversity of leadership teams brings more innovation and improves financial performance. According to a Boston Consulting Group study, companies that have more diverse management teams have 19% higher innovation-driven revenue. Plus, Canada is home to the world’s most diverse population, which is “a key advantage to Canadian CPGs as they look to bolster the diversity of their leadership teams, develop innovative products and scale globally,” says Chantal Hevey, a Partner at Boyden Canada. Diverse ways of thinking, strategizing, and executing mean broader coverage and fewer gaps. Without question, the CPG industry in Canada needs to find ways to complement and enhance its leadership teams through more diversity in background, gender, and ethnicity.

When it comes to professional background, concerned clients often ask us how to balance the need for a diverse background with the need for relevant experience. A marketing executive from an aerospace engine testing company may be well suited to a company selling equipment to food science labs. This individual understands R&D decision-making in highly regulated environments. Seeking out key aspects of commonality and synergy will mitigate the risk of a misfit and allow you to reap the rewards of a fresh perspective.

A good example is Ben Pasternak, a former tech entrepreneur who founded Simulate and created a chicken nugget simulation. While it could be argued that he needs some PR support to make the product sound a little more appetizing, the idea of a tech entrepreneur engineering food technology is certainly novel.

"You hire great people and you hire curious people, people who want to change, people who want to adapt."

Jeff York

Former CEO, Farm Boy

Seed product innovation internally

Innovation is an aspect of culture. It requires a certain value set and a strong tone from the top. The two must go together for it to be both genuine and successful. Companies that succeed through innovation allocate budget, incentivise trial and error, champion a flat structure, open doors, and bring innovation heads to the executive ranks.

Jeff York, the former CEO at Farm Boy who aggressively grew the grocery chain through its acquisition by Empire Company, was asked what it takes to do it all while keeping up with changing consumer habits. He replied: “You hire great people and you hire curious people, people who want to change, people who want to adapt.”

"At our core we are now an innovative packaging company."

John Pigott

CEO, Club Coffee

Form Canadian partnerships

Whether heading a Canadian brand or the local chapter of a global conglomerate, CPG CEOs can make a difference by seeking out opportunities to partner with innovative new products in Canada. This creates an opportunity for growth and differentiation, and it enhances the organization’s image to nurture innovation

in a domestic market.

Toronto-based coffee roaster Club Coffee did this very well, partnering with the University of Guelph to create compostable single-serve coffee pods that ended up on store shelves across North America. When asked about Club’s journey, CEO John Pigott reframes the description of the business, saying “At our core we are now an innovative packaging company.”

If the innovation isn’t achievable in-house, “there is opportunity to examine what’s out there and who could make a great partner to lend that competitive edge. And while you’re at it, use that same exercise to identify and attract tomorrow’s talent,” states Ron Burkholder, a Principal at Boyden Canada.

Invest in advisory capacity

Bringing in the outside perspective of a non-executive is another way to inject diversity of thought and innovative input. This can be accomplished through the retention of an executive coach, an interim executive specialist, a carefully selected advisory board, or via the statutory board of directors.

A good generalist executive coach can help a new CEO navigate uncharted territory by fostering self-awareness, building confidence, and unlocking potential. Board or advisory board members can be critical to mapping or informing an innovation agenda. Surprisingly, while many companies have become proactive in seeking diversity from an equity perspective, they still have not factored innovation, entrepreneurial or disruption knowhow in their gap analysis regimes.

A LOOK AHEAD

The CPG industry has proven itself as a vital contributor to the Canadian economy. While there are several important boundaries to overcome for the industry to regain its competitive edge, a reflection on organizational leadership is a valuable exercise that may help to revive an internal innovation agenda. The goal is not to turn over a new team, but to weave in the elements of leadership that will bring greater diversity to the table and set the organization and industry up for a new wave of success.

Thank you to Harangad Singh (Boyden) for research support.

Thank you to our contributors for their insights: Ron Burkholder (Boyden), Chantal Hevey (Boyden), John Pigott (Club Coffee), Jeff York (formerly Farm Boy).