We recently hosted a number of CEO’s, NED’s and other leaders to a round table where we discussed how the financial services sector is developing their ESG agenda

Over the past few months, we have had ever increasing discussions with our clients about the ESG agenda and how businesses are integrating it into their working practices. Many leaders still feel uncertain as to how best to manage the whole topic, so we felt it would be interesting to bring a number of leaders in to share thoughts and best practices.

Juliet Hardingham, Partner – UK Executive Search and Richard Plaistowe, Partner - Interim Management of Boyden UK’s Financial Services Practice hosted a virtual round table with CEO’s, NED’s and other members of the leadership team across Lending, Retail Banking and Insurance businesses who were able to provide valuable insights around the topic. The title for the discussion was:

The ESG agenda is becoming ever more important for our financial services clients. How are you developing this within your business and how do you see ESG impacting the sector longer term?

We had a very interesting and lively discussion with a huge amount of output and have detailed some of the themes along with key examples of what leaders are doing to overcome these challenges. We would like to thank all our guests for joining us and their input to a fascinating event.

ESG AGENDA

We started off by discussing how businesses are developing their ESG agenda and the consensus was that different financial services businesses have different priorities and each element of ESG should be taken in its own right, rather than treated as a single topic. We took each element and outputs from the discussion.

SOCIAL

The overall view was that Diversity, Equality and Inclusion is still a key and ongoing priority for all organisations and that this is a theme that will always need to be focused on by businesses. As you would expect, hybrid working has become very important for businesses to support their employees. Also, how financial services businesses treat their customers can have a real impact on their social presence.

The consensus from our banking guests was that social impact is a key priority on two levels. Firstly, the way they looked after their employees through the pandemic. Secondly, and equally importantly is how they work with their customers. How should they lend and what their customers do with the money they borrow will have a big impact on their social policies, so for them getting closer to the customer and understanding their business is key. At the same time there is an opportunity to educate borrowers on how to manage their money and particularly the fact that loans need to be paid back in a timely fashion, otherwise serious challenges can arise.

Diversity, inclusion, and belonging is still a key aspect of the social agenda for several of our guests from the insurance sector, as there are still a lot of traditional mindsets that need to change – it's not going to be a quick win, but key to the industry overall.

The CEO of a Building Society mentioned that whilst his organisation’s workforce is broadly female, this is not reflected in the make-up of the board, and a priority for the business is to create the right pathways for people to come through. They are also reviewing their ethnic diversity and are making inroads into ensuring the business reflects the nature of their customers. The challenge for them is that they are based in a non-diverse region of the country. There is a hope that with hybrid working they will be able to attract a wider talent pool, to increase both their ethnic and gender diversity. Several of our guests face similar regional issues.

Whilst for a business that has gone through a period of notable change the social aspect is key and they are currently going through a process of building a purpose for the business that links to how they support their customer base to ensure they are doing the right thing.

ENVIRONMENT

With COP26 taking place in Glasgow in the Autumn of 2021 and the ever-increasing discussion around climate change and the environment, we had a long discussion as to how environmental policies were developing. The easier part for all our guests was changing their own working patterns, which is all about the office, the commute, and how people act. However, the sector can have a huge impact on industry at large. For the lenders, we discussed who and how they lend to, and for the insurers we considered whether they would pull out of insuring environmental harming industries and sectors.

Banks and other lenders are currently assessing how much information they require on their clients’ carbon footprint and their environmental impact before they distribute loans. For mortgage lenders there is the opportunity to support customers to invest in sustainable energy solutions for their properties. One question that was raised was how a bank’s client can measure this and are they subsequently prepared to share this with their lender.

Another way banks can improve their Environmental credibility is to focus lending to “Green” energy projects and whilst it is still a relatively new concept, encouraging customers (whether homeowners or larger businesses) to focus on sustainable energy solutions is key.

“Questions at AGMs have changed, previously it was about remuneration, NOW it is all about diversity, fairness, representation of employees and what we are doing about the environment.”

CEO, BUILDING SOCIETY

Comments from our insurance guests were that as Lloyds is a very big player in insuring large-scale risk, Insurers need to ask whether they should be accelerating the transition away from certain sectors that are really damaging to the climate and if so, how best to do this. With the greater frequency of extreme climate events there are big challenges to pricing and overall underwriting strategies for climate change. This is an extraordinarily complex area for business leaders because if they completely disown those markets that are completely unpalatable they may well reduce environmental impacts but cause more social harm than they intended.

For businesses with large capital investments there is the opportunity to review their portfolios to ensure they are only investing in climate friendly businesses.

GOVERNANCE

Regulators and shareholders are becoming more and more focused on the ESG policies of financial services businesses.

Regulators are pressing for businesses to be a lot more transparent about ESG and are pushing for universal metrics and reporting mechanisms. However, they are still working out how to develop a strategy for environmental lending. This particularly relates to the capital regime and how that links to affordability, risk and the longer-term financial impact it will have on their customers.

Regulators are now expecting greater substance behind future reporting which will have a wider impact for organisations.

GOAL SETTING AND MEASURING SUCCESS

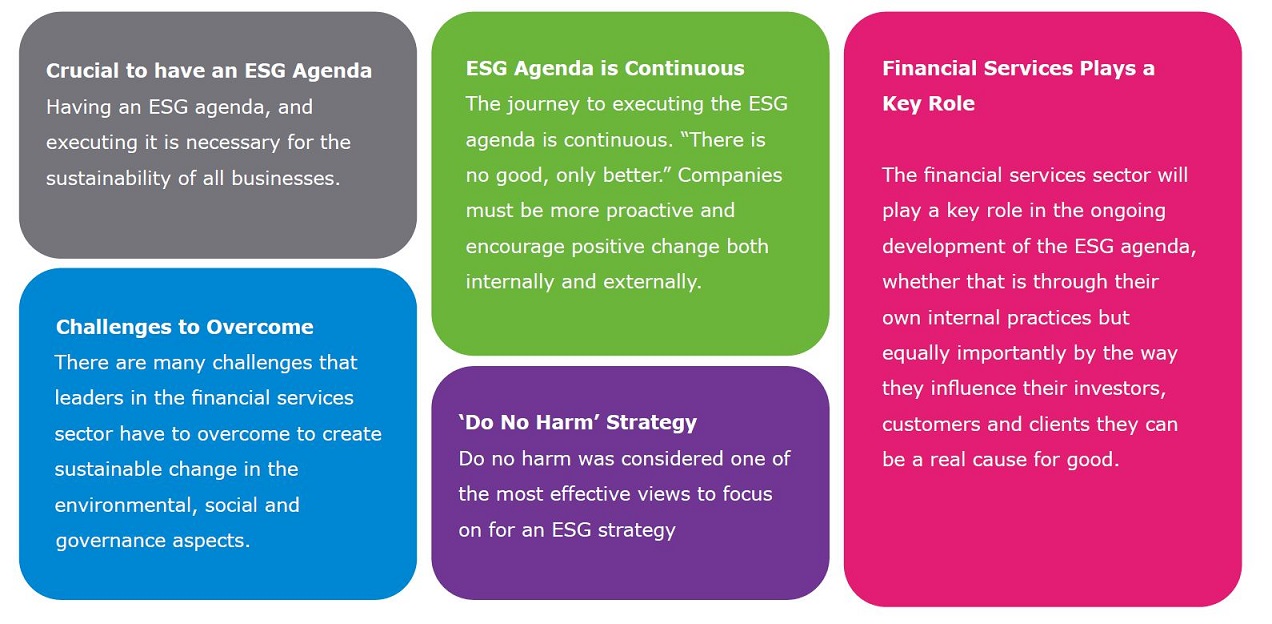

Once strategies are in place we discussed how you continue to measure success. Many firms want to reach net zero, others are focused on developing their purpose. When asked how you would know you have reached a successful conclusion, the consensus was that you wouldn’t and “There is no good, only better”. Whilst businesses can set targets, they need to avoid this being done purely as a box ticking exercise.

For one lender, it is important to bring it back to a simple focus on PURPOSE. They aim to measure business resilience beyond operational and financial and move to organizational culture and brand reputation. Overall, by bringing ESG into the purpose of the firm, they are aiming to help answer how they can deliver and measure better outcomes for all stakeholders in the future.

One banking CEO discussing the social aspect questioned how they can measure more, and to what extent should they hold their clients accountable to certain metrics, given they are social firms, and should have their own social metrics?

"It is crucial to behave responsibly when influencing this change so it will be a long path!"

CHAIR, LLOYDS MARKET

For another bank that invests in home environmental solutions, success will be seen when the cost of a loan for capital expenditure is reduced to less than the savings on bills. The CEO mentioned that he has seen this in the Australian market for Solar panels and his focus for the bank is how they can support customers in the UK to invest in these products. The market is very experimental at present and will grow at a greater pace when it becomes more economically viable.

It was further mentioned that banks should help polluters stop polluting rather than simply stopping funding. One CEO feels that it is better to have a seat at the table to influence and create change rather than withdraw from the business. They are looking to engage with their clients to stimulate their thinking and are looking at whether pricing on doing good and giving a discount for good practice will have an impact on performance. Her view is that if they can get clients on the right path to change, it is ultimately better for all parties.

One NED guest suggested there is a long-term horizon of 10 to 15 years to environmental activities, so it is artificial to define what good likes over this timeframe. Government and other relevant bodies do not really have the firepower to make a significant change, so whether it is the banking or insurance sector there are huge assets to invest. Success will be that all businesses will have played their individual part in how their investment is supporting the transition.

As previously mentioned there is still a market within insurance for no-go classes such as thermal coal, oil sands, and Arctic energy. By stopping insuring these industries, insurers could cause these businesses to close down and end these industrial practices, which would hugely damage their clients’ existing investments. Refusing to support new investments is one thing but trying to introduce incentives to get them to move away is a better strategy as it is unethical to put everyone out of business.

To attract and retain the right talent, the ESG purpose of organisations needs to be really genuine

ESG has now become a hygiene factor. A few years ago, it was new and interesting and a way for businesses to get ahead of the market, but clients, customers and investors demand it now. If a company does not take it seriously and is not measuring appropriately, it will lose out. ESG has now become an attraction and retention issue – both for new employees as well as customers and clients. At the interview, candidates are demanding to understand their potential employer’s ESG strategy and one leader mentioned that his postbag (or inbox) is now full of customers wanting to know what they are doing about the environment. Customers and employees really care.

But can this be focused sector-wide, or does it need to be looked at on an individual basis?

"If this simple principle is applied to all aspects of ESG, do no social harm, do no environmental harm, do no harm to diversity, businesses will have an effective minimum strategy to adopt on decision making."

CEO, COMMERCIAL BANK

If you look at company brochures, every business is talking the same language, with every company brochure having an ESG statement, but is it just words or is there substance? Increasingly, we will see more reality behind the statement, not because businesses are necessarily supportive of the approach, but because external pressure from the regulators to be more transparent will ensure that companies stick to their word. The proof will be greater transparency to show what companies are doing to really support the ESG goals.

For the insurance market who is insuring large companies all over the world, there is more collective influence than individual contribution. If they take a step back, they can redirect their investment and underwriting support and encourage the banks that support the debt aspect of the corporations, which will influence the overall agenda.

For others, ESG remains at an individual level, and establishing a base level and building on that to start delivering societal good are the first steps to inform their decision making. If this simple principle is applied to all aspects of ESG, do no social harm, do no environmental harm, do no harm to diversity, businesses will have an effective minimum strategy to adopt on decision making.

If this simple principle is applied to all aspects of ESG, do no social harm, do no environmental harm, do no harm to diversity, businesses will have an effective minimum strategy to adopt on decision making.

CONCLUSION

A big thank you to all our guests for sharing their views and exchange of ideas and challenges, in summary: