In a continuation of interview excerpts from the 2020 Hunt Scanlon report, Boyden partners Anita Pouplard, Global Practice Group Leader, Kathleen Dunton, EMEA Leader, David Law Man Co, APAC Leader and John McCrea, Americas Leader provide their perspective on how talent management should be at the core of recovery strategies for PE firms.

How should current CEOs be strategizing to best perform post pandemic?

Anita Pouplard, Managing Partner, Boyden France and Global Practice Group Leader:

In one of its research studies, McKinsey showed that during the recession of 2007–08, those companies acting with a through-cycle mindset were best positioned to accelerate out of the downturn. One key lesson from that experience is that those that moved early and decisively in a crisis performed best. Times of disruption can also be times of opportunity. This of course will be easier for firms less affected by this crisis and with strong cash reserves.

It is no longer a case of “how digital transformation could impact our company?” but “how fast should we accelerate to full deployment?”. A significant portion of white collar employees have been able to continue working from home as companies were able to quickly provide the necessary collaborative technologies and remote working policies. This transformation should be applied at the core of any company and also through the development of new areas of opportunity. This lock-down period has created new needs, new expectations, and we are starting to see new customer behaviors and market dynamics.

Capturing and managing these new growth opportunities will be at the heart of value creation. Now more than ever, CEOs will need to have a vision and managerial courage as those changes might require new skills within the leadership team. In a number of cases, this will result in an evolution of the organizational practices and structures in order to create a more collaborative and agile working environment. CEOs should then work closely with their executive team to identify critical roles and attract the best talent for those roles.

How has working from home/remote work impacted the Chief People Office/CHRO role in the PE sector?

Kathleen Dunton, Managing Partner, Boyden Germany and EMEA Practice Group Leader:

COVID-19 has accelerated remote work practices to an incredible degree. In the pre-lock down period, companies were most often unwilling to consider this option. If we consolidate the feedback from Boyden clients, we see that a vast majority of their employees would like to keep the possibility of working from home; companies will not be able to go back on this option. People like to have the freedom to choose how and where they work; more conservative organizations will have difficulties retaining and recruiting their top talents if they demonstrate that they are inflexible in this.

At the same time, CHROs are telling us that efficiency and productivity is suffering when it comes to brainstorming, defining a road map or reinventing new models. As Private Equity companies are under tight deadlines to perform, they need to carefully consider workforce capabilities and the capacity needed in order to deliver on their business plans. Knowing that Human Capital is one, if not the single most important asset a company has, they will need to take three variables into account – employee motivation, impact on operations and the financial results.

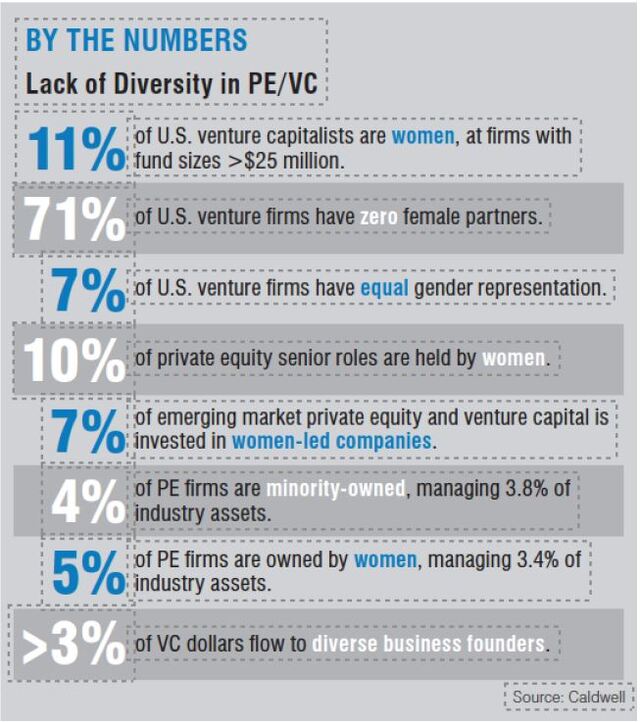

In future, the role of the CHRO / Chief People officer will be even more critical for defining the company culture and in driving the HR road map to meet value creation objectives. COVID-19 has increased the sense of urgency and the need to have modern, business oriented HR people. The HR function is facing a number of new challenges: they need to be creative to increase workforce engagement and commitment, to revisit company policies, define new onboarding processes, implement new tools while at the same time embracing the absolute necessity of diversity.

Research shows that organizations with diverse management teams have EBIT margins that are nearly 10 percentage points higher than those with below-average levels of diversity. Firms that take the lead on diversity initiatives can create a virtuous cycle that allows them to attract strong talent, nurture innovation, and lay the foundation for sustained growth.

The CHRO / Chief People Officer position requires a more modern and strategic approach to support the CEO in his/her plans, develop leaders, and create a culture that can make or break a company’s ability to meet aggressive performance targets.

How will CHROs and CEOs impact value creation for PE firms post pandemic?

Pouplard:

The collaboration and trust between both the CEO and CHRO to guarantee a best class management team will be the backbone of a successful organization going forward. A cohesive unit at the top will lead to a stable organization overall and in a context of the war on talent where everyone is fighting for the same profiles, top performers will not only stay, but potential new employees will be more inclined to join an entrepreneurial opportunity and go the extra mile.

The value created with this managerial approach would have a great impact on business performance and employee satisfaction. The costs and amount of lost time and speed related to replacing a top performer can be substantial.

Dunton:

To be successful and deliver upon the agreed business plan, the CEO must be able to mobilize all of the organization’s sources of performance. A strong CHRO will be instrumental in integrating all the performances levers as far upstream as possible (identifying the opportunities linked to the human factor, the expectations, behaviors and needs of employees to nurture and support the strategy of the business. This is why a “People Success & Intelligence” oriented company takes greater account of the collective, transversal responsibility, impact and contribution of managers with regard to sources of performance, and in particular human sources of performance.

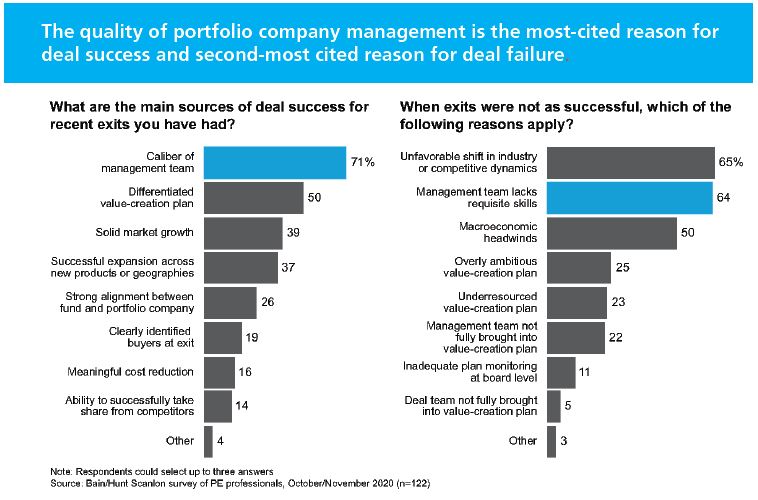

In one of its articles, Forbes estimated that half the time when portfolio companies failed to achieve the expected returns, it was due to leadership issues. To optimize the management team’s operational efficiency under strong EBITDA and time constraints, it is critical to address human capital needs and opportunities as soon as possible. That’s where a strong CHRO working hand in hand with the CEO is vital for the company.

In this "pressure to succeed" environment, what is the importance of maintaining active talent pipelines?

John McCrea, Managing Partner, Boyden California and America Practice Group Leader:

Leadership and critical functional executive talent is perhaps the single most important element in manifesting the success of an investment. PE requires executives who have superior judgement around the key drivers in a business. PE needs speedy access to executives with these skills and mindset. Success or failure of an investment is often determined by rapid execution in the first 100 days post acquisition. Having the right people in place can make a huge difference here. Building and having an effective pipeline enable PE firms to act quickly to fulfill these needs even on an interim basis.

Many mid-market PE firms are recognizing that we are not simply “recruiters” who perform a search transaction, but as senior partners who are intimately engaged with searches, are in fact experienced experts who can help them optimize the value they gain through human capital.

This is manifest on an ongoing basis to identify “backable” executive talent focused on Board Members, CEOs and CFOs, etc., focusing on capabilities that will “unlock” a potential company investment opportunity. It is also manifest pre-deal in bringing on subject matter experts for deal evaluation and due diligence, or doing a talent mapping in advance of a search opportunity to be ahead of the curve in anticipation of a potential search.

And it is manifest post deal with potential part-time, interim or Executive Chairman roles, as well as potential advisors/consultants when appropriate. We are also called upon on an ongoing basis for our leadership consulting, team building and coaching expertise.

Lastly there is ongoing work with Partners to understand key issues with portfolio companies, or with respect to potential investments, to identify talent ahead of the curve and to provide leadership consulting, team-building, coaching, mentoring, etc. resources for portfolio companies.

To do this, we’ve had to rethink our traditional transactional model around executive search and engage in a pure partner relationship.

The upshot is that whether it is a traditional search, identifying talent ahead of a deal, or leadership consulting, all of what we do is about helping PE firms maximize the value of their investments via human capital, all of which can give PE firms a significant competitive advantage.

How have Asian markets performed and what are the emerging trends, particularly in China?

David Law Man Co, Partner, Boyden China, and APAC Leader:

Over a year since the covid-19 pandemic started, we have seen the impact on the secondary market with companies’ valuation. The pandemic has also shown which companies were “crisis-proof” being able to perform quite well to very well despite the challenging environment. Companies with more digital elements were able to grow faster, as well as their valuation.

The high interest for SPAC has also impacted the PE/VC investment. Initially there have been mostly interest from US companies in SPAC, however there has been a momentum and appetite building in the region for SPAC. The example in Southeast Asia, where tech-focused startups and unicorns are eyeing SPACs alternative as a more efficient monetization or exit option, versus conventional IPO. Another example with Chinese companies having strong revenue growth, high innovation, and a sizable addressable market, that are looking for new channels for funding. Investors will be competing to acquire these types of companies through SPACs.

Regarding industry verticals, healthcare and high tech sectors have been dynamic Semiconductor has been a prominent sector, in particular with chip shortage starting to severely impact the automotive industry and now disrupting the consumer and industrial chip supplies.

Huge investments are being poured in China in the industry to build more capacity as well as building a stronger local supply chain. Huawei has been aggressively ramping up investment in local semiconductor companies over the past 18 months through its venture capital arm, and many PE/VC players in the market have followed suit.

Boyden's PE/VC Practice

With more than 40 Partners and their teams across the globe, the Boyden PE/VC practice group connects PE and VC portfolios with inspired executive talent strategically relevant to each client’s business.

We leverage the entire Boyden global network reaching the best talent wherever it is found, and bring a flexible, more creative mindset to working with businesses seeking transformational leaders who can motivate diverse teams to achieve their goals.