Gain valuable insights into the current state of compensation and work in the asset management industry with Boyden's in-depth survey.

In the summer of 2023, Boyden’s New York team conducted a survey of investment professionals working for asset managers around the subject of compensation and work models. Many investment professionals participated in the survey.

The asset management sector is currently facing challenges and opportunities in equal measure. In a world of ever-increasing regulation, changing interest rates, digital disruption, and rapid growth in the popularity of index tracking or smart beta products, asset managers must adapt and evolve quickly.

Boyden has been at the center of the debate regarding active versus passive investing, helping clients answer how they remain current in active investing as well as sourcing Data Science candidates for the former.

We have been consistently surprised by the wide range of compensation at similar-looking firms. This range can be as much as 400% from the bottom decile to the top decile for the same experience level at the same nature of the firm (long only or hedge fund).

The key drivers for compensation are the size of assets/profitability of the firm and the culture of the organization. Broadly speaking, the larger the AUM and the more profitable the firm, the better paid the analysts. Typically, profitability can be a more reliable indicator of compensation than the size of AUM and this is particularly true for hedge funds.

There is more uniformity of compensation at very large, long-only asset managers than at smaller ones, but even between the large firms, there can be a two-to-one differential for similar-looking analyst jobs at different firms.

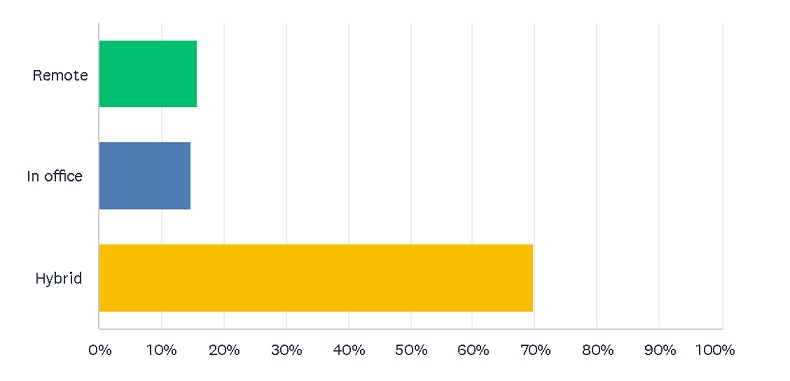

Strong preference for hybrid work

The strongest conclusion from the survey is the overwhelming employee preference for a hybrid work model.

Almost 70% of respondents favored hybrid working compared with 16% preferring remote and 15% in office. Furthermore, when questioned as to whether the work model offered by a firm would affect their decision to accept a job offer, 76% replied in the affirmative.

Which Work Model Works Best for You?

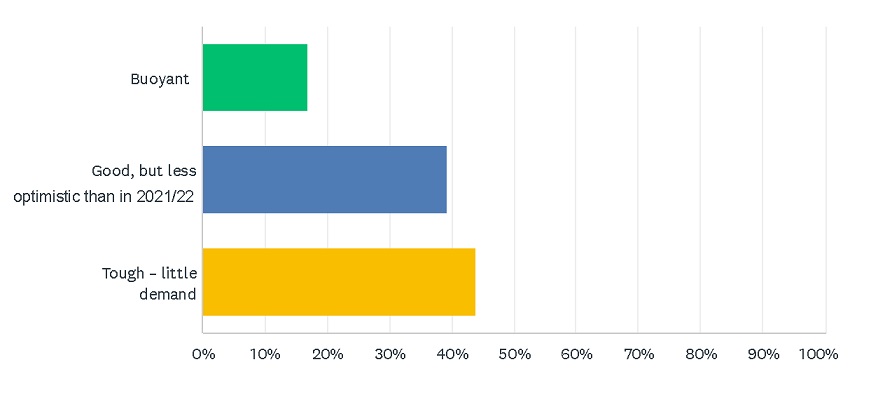

View on the current job market

Despite national unemployment rates being close to multi-generational lows, only 17% of surveyed candidates view the current job market as buoyant and 44% view it as tough, with little demand.

How Do You Currently Feel About the Job Market?

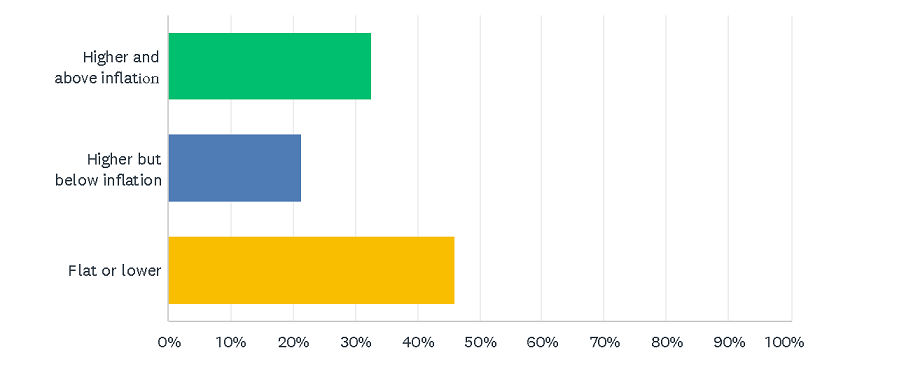

Trends in fixed and variable compensation

33% of respondents reported that their 2023 base had increased above inflation, while 46% reported base compensation being flat or lower.

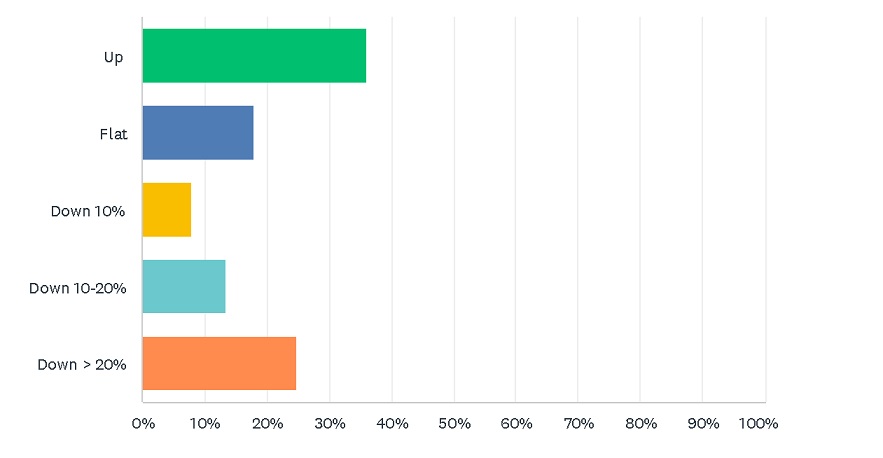

36% reported a rise in 2022 bonus, with 18% flat and 46% lower, 25% reported that their bonus fell by over 20%.

Note: It is possible that our anonymous survey had a skew towards younger employees which would likely produce more positive compensation trends than for the industry as a whole

What Was the Change in Your Fixed Compensation in 2023?

Was Your 2023 Variable Compensation….

Summary

The key takeaway from our survey is the wide range of variability in compensation across the industry. Perhaps that is to be expected given the range of asset classes and the range and scale of the participants’ firms. As a rule, Equity analysts in the 3–10-year experience range can expect to be paid around $250-800k total annual compensation. We are of the view that 2023 will be a decent year for variable compensation, and certainly relative to 2022. In 2023 the tailwinds for most asset managers have been rising marginal revenues and falling marginal costs. The profitability derived from these factors will also look better in contrast to the second half of 2022. Offsetting that good news is the fact that net outflows to passive from active, combined with fee compression, continue to present secular headwinds. Employment demand has also been tepid, even for the in-demand sectors of Technology, Healthcare, Consumer discretionary and Industrials analysts. On the subject of the Hybrid model, we observe a tendency to maintain an official 3/2 work week, while allowing individual teams to determine their specific needs. A move to enforcing a 5 day a week in-office rule as official policy could be considered a risky competitive position to take.

About Boyden United States

Boyden’s New York team is part of Boyden’s global financial services practice and has a tailored focus on Asset Management. The New York team’s core competency and experience lie in this vertical, as evidenced by 92% of search mandates having been in the asset management space in the last three years. Their history goes back to 2012, having formed with the goal of bringing a new high standard to executive search for the finance industry. The NY founding partners bring over 80 years of equity industry experience in a variety of senior roles, on the buy side and the sell side.