Boyden's President and CEO Trina Gordon advises companies should consider incorporating executive metrics and incentives to meet their diversity and inclusion goals.

This article was originally published on the Wall Street Journal’s website. Click Here to view the original article.

Pressure from investors and lawmakers to boost gender diversity in the executive ranks and the boardroom are prompting more companies to consider a wider array of C-suite candidates and, increasingly, tie performance reviews and pay to hiring targets.

“Diversity is necessary to drive above-market performance,” said Charlotte Simonelli, finance chief at Realogy Holdings Corp. , a residential real estate-services firm. “And companies that do not focus on both diversity and inclusion undercut themselves by dismissing a broader set of experiences and viewpoints that can help them get to even better answers, faster.”

A recent study by S&P Global Markets Intelligence confirms her view. It found that companies with female chief financial officers are more profitable than those without. The study examined the largest 3,000 U.S. companies from 2002 to mid-2019. Those companies saw a 6.2% increase in profitability during the first 24 months after the appointment of a female CFO, compared with those with male finance chiefs.

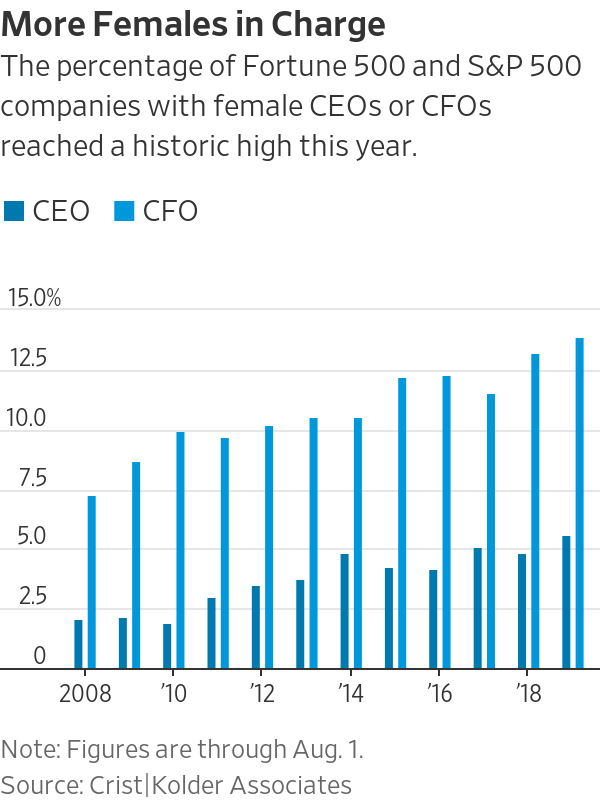

Still, the number of female executives at large U.S. companies is quite low. In 2018, 12.8% of CFOs of Fortune 500 companies were women, according to data from Spencer Stuart. During that year, only 9% of companies in the Fortune 500 appointed female CEOs, according to the recruiting firm.

That’s changing as more investors insist on diverse executive teams, and as regulators weigh in. California last year passed a law mandating that all public companies with headquarters in the state have at least one woman on their boards by the end of this year—a decision that is expected to influence boardrooms and C-suites across the country.

Sixteen percent of CFO appointments in the Fortune 500 since the beginning of the year—13 out of 80—have been female, Spencer Stuart data show. For CEOs, the percentage figure is the same, with 9 of 57 CEO roles going to women.

Recruiters say companies in the past year have increasingly requested more diverse candidates. Meanwhile, more companies are setting internal recruitment and promotion targets that promote diversity.

At American Water Works Co. , over half of all company transfers and promotions in 2018 were taken by women, ethnic minorities, people with disabilities or veterans, said Susan Story, the Camden, N.J.-based company’s chief executive. And for 90% of openings, American Water targets a diverse range of candidates—a goal that is intended to make sure the company’s workforce represents its customer base. The U.S. utility-sector workforce has historically been mostly male, Ms. Story said.

Ms. Story recently recruited her second female CFO, Susan Hardwick, and two of the company’s three new board members are women. She said more boards and executives need to become aware of the financial and performance benefits of having diverse leaders.

“The only way this is going to change is when companies become convinced that this is best for their business,” Ms. Story said.

For companies that aren’t emphasizing diversity, recruiters are providing a nudge. They’re recommending that clients address unconscious recruitment biases by reviewing language used in job postings. They’re also encouraging the use of artificial intelligence to analyze candidate applications, and they’re recommending that a diverse set of managers conduct job interviews.

Recruiters also are advising that companies integrate into corporate and executive metrics efforts to meet diversity and inclusion goals. This ensures executives become personally invested, said Trina Gordon, president and CEO of executive search firm Boyden World Corp.

“Tie it to the incentives,” Ms. Gordon said. “When you are struggling to achieve diversity, it is up to the leadership and the board to say, ‘We are making an economic difference.’”

Bob Sulentic, the chief executive of CBRE Group Inc., has done just that. A few years ago, he began holding executives personally responsible for advancing gender and ethnic diversity at the Los Angeles-based real estate-services firm.

“It’s not hard to figure out we are in a sector that is not diverse,” Mr. Sulentic said of commercial real estate, an industry historically dominated by white men. Executives who report to Mr. Sulentic have been assigned certain priorities for promoting gender and racial diversity, he said. CBRE does not disclose specific hiring and performance goals, but it has an executive inclusion council that measures and monitors progress and reports quarterly to Mr. Sulentic.

Failure to meet diversity goals is reflected in performance reviews, which ultimately can affect bonuses. “This creates accountability,” said Mr. Sulentic, who in April hired a female finance chief, Leah Stearns.

The knock-on effect across industries is that executives from diverse backgrounds who can help companies reach these goals are increasingly in the sights of corporate headhunters.

Female CFOs at large U.S. companies—including Peggy Smyth of National Grid and Ms. Simonelli at Realogy—say they have received more outside offers in recent months, underlining an increased interest from companies to poach female executives.

Unibail-Rodamco-Westfield SE, a global shopping mall operator headquartered in Paris with a large footprint in the U.S., last year began tying 10% of senior management’s compensation to progress toward the company’s corporate social responsibility goals, including gender diversity.

Not enough companies recognize the long-term financial advantage of hiring female executives, said Jaap Tonckens, the company’s finance chief. About 40% of Unibail-Rodamco-Westfield’s board is female, but the company and the industry needs to work harder to attract more female executives, Mr. Tonckens said. “Investors see it as important,” he said.