Originally published in Boardview magazine

Businesses are facing extraordinary disruption in increasing frequency, and leaders are faced with a growing pressure for greater accountability to address these circumstances. However, many boards are not equipped to deal with extraordinary disruption, and they are often found to be unaligned with their management teams. Instead of having their finger on the pulse, they appear as out of touch and lacking the leadership of the chair.

Boyden Finland partnered with Henley Business School and DIF to take a closer look on whether and how Boards add value in turbulent times. Data is based on a global study conducted by Andrew Kakabadse, Professor of Governance & Leadership at Henley Business School, as well as a study executed by Boyden Finland. The study was done through structured interviews with owners, major shareholders, chairs, and CEOs (n=33 interviews from different ownership structures: private equity, family office, and listed companies) in two waves, in the spring of 2020 and spring of 2022.

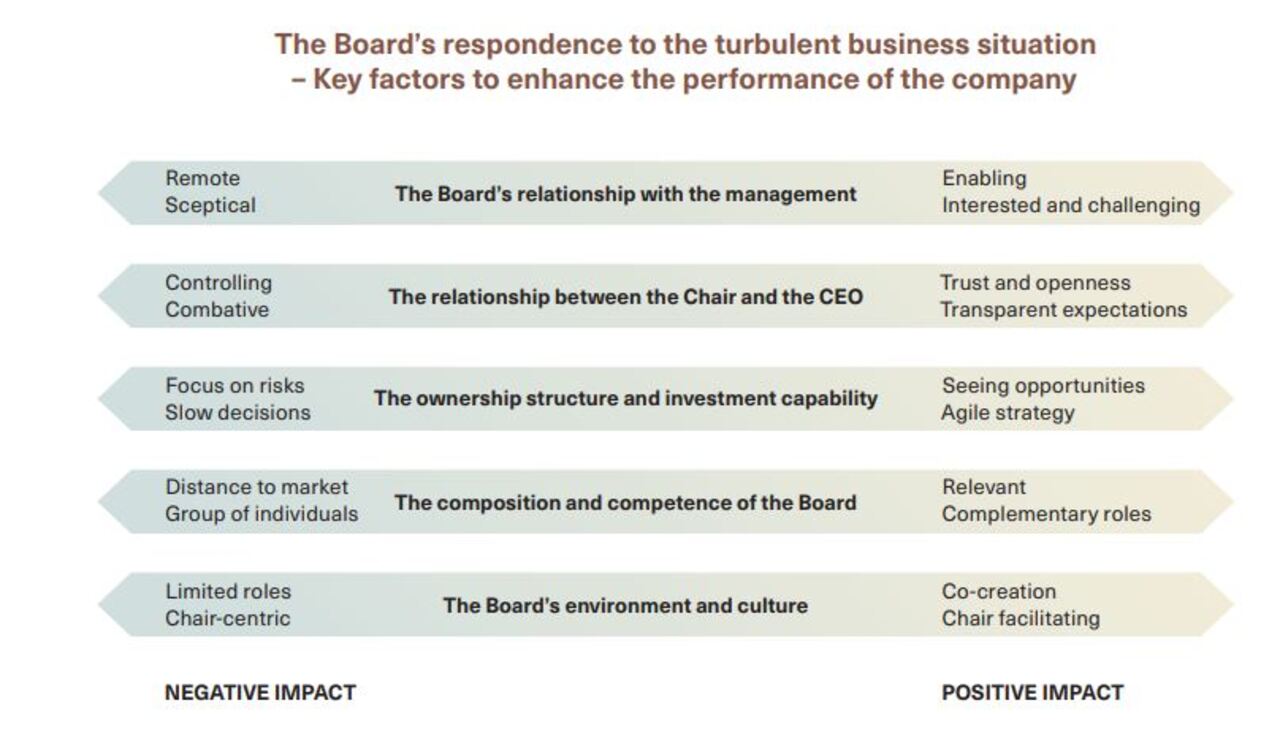

Events of extraordinary disruption can be classified into a four-fold matrix with the attributes planned, unplanned, internal and external. Covid-19 and its consequences, as well as the ongoing war in Ukraine, are examples of unplanned and external extraordinary disruption (1, during which alignment of the Board and top management of a company are essential. At the same time, the global study of more than 5 000 boards across 16 countries indicates a unique gap at top levels: 33 % of top teams are divided on mission/vision and as much as 80 % of Board Directors do not share a clear view of competitive advantage of the company (2. Trust between critical decision makers, clarity of the owners’ views, and leadership capability of the Chair were some of the key topics that were raised in our Finnish study. Together with our findings and insights from the leading global studies, we identified three main elements enhancing the performance of the company during turbulent times.

Trust to the CEO grew during the weeks and months. New talent emerged in the top management.

Chair of a listed company

Trust between the Board Chair & the CEO

The majority of Chairs have CEO backgrounds, and they can relate well to the challenges of the CEO, also in turbulent times. In the best case, this increases trust and openness between the Chair and CEO. In our study, most CEOs and Chairs said that difficult times have brought them closer to each other and increased the level of trust.

Extraordinary disruption may lead to a need to temporarily reconsider the focus of the Chair and CEO. According to our study, the boards generally raise the level of control, and Chairs increase the frequency of communication with the CEO. Many CEOs in this situation described the board’s focus as ”operative” or ”short-term”. Trust and openness in expressing and sharing the expectations between the Chair and CEO in leading the company through extraordinary disruption were essential to avoid confusion and frustration in their relationship.

Whilst the CEO and management focused on risks and costs, I decided to signal trust and focus on future opportunities.

Chair of a listed company

Guidance of the owners The research of Professor Andrew Kakabadse showed that improving a company’s reputation and stewardship results in a greater company value(2. Reputation can be enhanced by company culture and values which the board and executive team cultivate, as well as implications those bring to strategy, its implementation, and strategic decision-making. Those attributes have only lately been paid attention to at board narratives or board executive search. The Nomination committees should promote this viewpoint strongly when preparing proposals for the coming AGMs.

Ownership matters. Owners decide upon the board composition and can therefore greatly affect how the board can add value. Appointing board members not only by their skills or competencies but also by their values, considering the board dynamics, is too rare. It needs special attention and interest of the owners to understand the dynamics of the current board and what might be needed for the future success of the company. This is naturally linked to the company’s strategy, risk map, and capabilities, but also understanding the dynamics between individual board members, the Chair, and the executive management.

A well-performing team needs a common understanding of its goals. Boards need to work on interpersonal communication skills and challenge themselves to create greater value as a team than as individuals.

The Boards with transparent governance tend to be more performing, and fair play companies tend to attract and ultimately retain better directors and also executives.

Ludo Van der Heyden, Professor of Technology and Operations Management; The INSEAD Chaired Professor of Corporate Governance

A clear communication of owner’s strategy gives the board, especially the Chair, guidance for their decision making. In time of turbulence, clear decision making, and willingness to take action are crucial. Being aware of the long-term commitment, willingness to invest, risk appetite and strategic considerations of the owners, the board gets a clear framework to work with.

Key traits of effective chairing

The role of the Chair has become increasingly significant in ensuring the organization’s success. Extraordinary disruption highlights the importance of the Chair’s leadership skills. Boyden has studied the Chair’s role and leadership and its effects on the company’s success. Five key traits were crystallized in the study conducted just before the Covid19, four of which were related to the Chair:

- become the enabler

- make way for inclusive collaboration,

- build beyond the boardroom

- establish a leadership culture that cultivates motivated, curious, and accountable directors.

The fifth trait pointed at the owners, proactively shaping the board composition and having an agile succession for the Chair. The importance of those traits has increased significantly.

Beyond the ownership structures, when the Chair builds the leadership culture on clear governance and leads with her own example the company tends to perform better and attract new talent to the board and operative levels.

The best Chairs avoid informational asymmetry between the top management and the The Boards with transparent governance tend to be more performing, and fair play companies tend to attract and ultimately retain better directors and also executives. – Ludo Van der Heyden, Professor of Technology and Operations Management; The INSEAD Chaired Professor of Corporate Governance shareholders by maintaining a transparent and accountable relationship with all stakeholders.

Essential for the Chair is to create a leadership environment where decisions are made with the highest possible understanding of matters at hand. This type of leadership environment pushes the CEO to bring forth more diversity and points of view beyond the typical operational managers and financial executives. With extensive information, the board can challenge and support the CEO as needed. By shattering the hourglass mentality and admitting the legal responsibility of the role, the Chair can enhance leadership behavior towards both vertical directions.

To ensure that the board adds value in extraordinary disruption and beyond, the Chair should monitor the pulse of the board constantly and evaluate the board’s practices and competencies, accordingly, reviewing results with the owners for consideration – considering contextual factors such as time and culture.

References:

1) Boards in challenging times: Extraordinary disruptions; Alvarez & Marsal and Henley Business School, 2022.

2) Presentation of Mr. Andrew Kakabadse, Professor of Governance & Leadership at Henley Business School, in DIF’s seminar “Boards adding value and defending reputation in great turbulence” on September 1st, 2022 at the British Embassy in Helsinki, Finland.

3) Modernizing The Mindsets Of Board Chairs; Lahti, Carita & Panula, Nelli, Boardview 12/2019.

4) Setting a tone of Fairness at the Top By; Ludo Van der Heyden Business Compliance, INSEAD 05/2013