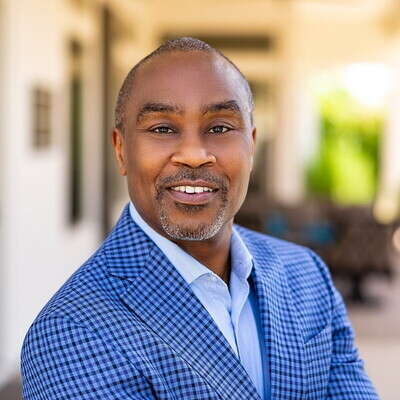

This article was originally published by Directors & Boards magazine - please click here to view.

Know the symptoms of human capital issues in the boardroom and how to properly evaluate them.

Start-up stories have become part of the fabric of Silicon Valley and other hubs of innovative enterprise. The 1980s flagship opening of a business that soon became a staple of American culture was no different.

The company had a meteoric rise: from a single storefront in its opening year, it was operating out of 800 by year three, thanks to significant contributions by investors. Eleven years later, the company went public and swiftly reached its pinnacle, with a worldwide presence of 60,000 employees across 9,000 stores and revenues of $5.9 billion. The company’s stunning success made its demise ten short years later all the more shocking.

While no one denies that Blockbuster’s infamous refusal to acquire Netflix in 2000 was the beginning of the end, there is more to the story — especially for those of us concerned about sound governance. In reviewing the history of Blockbuster’s missteps, many more errors become apparent, such as late fees making up a whopping 16% of its revenues in 2000 (Blockbuster’s late fees played a central role in Netflix’s origin story), frequent CEO and strategic changes, and the bewildering decision to abandon online access and streaming in favor of storefront rentals from 2005 to 2007. To a governance researcher and practitioner, Blockbuster’s story points to a core problem of human capital redundancies and gaps within the board. This article explains how such gaps and redundancies emerge, the symptoms of board-related human capital problems and a framework for strengthening your board’s human capital.

The Road of Good Intentions

Directors accept substantial legal and ethical responsibilities when they accept a position on a board, and these responsibilities are assumed collectively. This means that knowing, trusting and working well with one’s fellow directors is of prime importance — and the search for a new director rarely, if ever, extends beyond the existing directors’ networks. Although this sourcing strategy provides the board with a sense of safety, that safety may be an illusion. The risk of searching only within the board’s existing circles is cementing a homogeneity of thought, experience and competencies that can create real difficulties when boards need to anticipate and help companies navigate the volatile environments and competitive challenges they face today. I suspect that if we examined Blockbuster’s board during this period, we would discover several gaps and redundancies in its human capital that ultimately explained the puzzling decisions that assured its disaster.

This reveals that the issue of board diversity — which itself has fallen under intense scrutiny — centers on a question we can all agree on: Are we, as the board, collectively and sufficiently equipped to fulfill our duty of care to the organization? Duty of care involves such things as being knowledgeable about the organization’s operations, exercising long- and short-term thinking, posing incisive questions, comprehending hazards and deliberately gauging which risks are acceptable. Confirming we are adequately fulfilling our duties requires sober self-examination that identifies human capital redundancies, gaps and misalignments between the board and organizational stakeholders. This self-examination is critical because failure to fulfill our responsibilities results in blind spots and disastrous missteps — such as H&M’s 2018 ad campaign featuring a Black child wearing a hoodie stating “Coolest Monkey in the Jungle” — and leading all the way up to organizational death, as in the case of Blockbuster. The longer board homogeneity is allowed to persist, the more vulnerable the board is to overlooking risks, signposts and critical moments when executives’ decisions need to be challenged rather than simply approved.

Symptoms of Human Capital Problems in the Boardroom

Here are two key symptoms that suggest your board may have human capital redundancies, gaps and misalignments.

Failure to identify emergent opportunities and markets. One symptom is when the organization’s leadership, particularly the board, is unable to recognize and capitalize on new and evolving trends, needs or potential areas for growth within the business environment. This failure can result in missed chances for innovation, growth and competitive advantage, increasing the risks of stagnation, competitive vulnerabilities and even financial setbacks. These organizations also find it challenging to stay relevant and navigate changing industry dynamics. For example, by the time Blockbuster finally attempted to become a contender in online rentals, it was hopelessly behind its competitors and never recovered. Identifying and addressing human capital gaps can help mitigate these risks by improving the board’s ability to create effective strategic plans, understand their market and architect innovation.

The same problems continue recurring. Competency gaps also may be the culprit when certain problems keep recurring, which suggests that the root causes have not been adequately identified, understood and addressed, or that innovation and needed diverse perspectives are lacking. In such cases, the lack of deep understanding and effective solutions reveal potential gaps in knowledge, skill and other competencies. If these gaps are not identified and filled, recurring problems can evolve into stagnation, missed opportunities, competitive disadvantages, employee disengagement, resistance to change, poor decision-making, ineffective problem resolution, and ultimately erosion of stakeholder trust in the organization and the board. A glaring example of this is the persistence of glass ceilings, despite Marilyn Loden first pointing out the phenomenon during a 1978 panel discussion on women’s goals and dreams. The fact that women remain underrepresented at the highest levels of organizations more than 40 years later, despite the proliferation of legislation, nonprofit organizations, diversity roles and organizational programs designed to close the gap suggests we have not yet uncovered and solved the root problem. Similarly, Shaun Harper pointed out the troubling lack of executive buy-in for diversity programs.

Addressing these and other symptoms of problematic board-related human capital in a lasting way requires a more comprehensive framework and expanded approach.

Evaluating and Strengthening Your Board’s Human Capital

Every board member has a responsibility to ensure that, as a group, it represents the necessary knowledge, experience and viewpoints that allow it to effectively monitor company performance and constructively challenge new ideas and strategy. Not only do board members accept this responsibility when they assume a seat at the table, but shareholders, stakeholders and investors are increasingly holding boards accountable to this. Such measures of accountability include the spike in stakeholder activism, increased scrutiny of whether boards are engaging in periodic and rigorous self-examination and refreshment practices, and requirements to disclose board skills in the proxy statement. Boards must assert their intentionality and improve their approaches for avoiding human capital gaps and swiftly addressing them when they occur. Specifically, boards need a robust process for regularly monitoring and maintaining board member competencies — both individually and collectively. This process generally needs to consist of the following four elements, which should be repeated annually.

Make a commitment to human capital. At your next board meeting, put board succession planning on the agenda. Discussion should address board size, the process for reviewing director performance, and the methods for reviewing the board’s competency profile and filling skill gaps. This needs to be more than a check-the-box discussion. Instead, each member needs to understand and accept their responsibility for ensuring the quality of the board, authentic evaluation and discussion by the board members needs to occur and the measures for accomplishing this objective need to be established as explicit board priorities.

Identify the board’s competency needs. An effective performance review process hinges upon understanding the human capital competencies your board needs. Importantly, there is no universal list of needed competencies, as these are dictated by the company’s current life stage, challenges, opportunities, environment, strategic plan, stakeholders and overall outlook. However, several sets of competencies are considered central to boards fulfilling their duties of care, loyalty and obligation. Compare this list to your own board’s needs and realities and adapt it accordingly.

- Management and leadership expertise. CEO, CFO or CTO experience; profit-and-loss experience

- Functional expertise. Accounting, finance, human resources, legal/regulatory, marketing or public relations and technology

- Governance-related expertise. Corporate leadership and governance and board expertise

- Specialized expertise. Compensation, environment, government affairs and public policy, mergers & acquisitions, operations, strategy development, talent development and international business experience

- Emergent challenges. AI, cybersecurity, risk management and supply chain knowledge

- Leadership qualities and behaviors. Dedication to social issues, emotional intelligence, genuine concern for the company, intellectual curiosity, professional and personal ethics and integrity, time to devote to board work, and a working style that reflects collaboration, collegiality and a consultative approach

Evaluate the board individually and collectively. The customized competency list created in the previous step can be used to create an effective tool for evaluating board members and the board as a whole. An evaluation matrix often is helpful in this exercise, where the competencies are listed in rows and a column is created for each director. Each board member should then be rated according to their degree of mastery in that competency. To create an illuminating board evaluation, every board member should evaluate both themselves and every other member.

In addition to producing the total board assessment, these scores can be examined on a director-by-director basis to reveal discrepancies between each director’s assessment of the total board compared to other directors’ assessments, thus revealing possible biases and information gaps as well as possible weaknesses and redundancies.

Create an action plan. The board assessment provides stunning insights into the weaknesses, redundancies and discrepancies across board members. These results should be empowering rather than discouraging. Growth and change are inevitable. Therefore, directors should not be alarmed or dismayed if they discover that they and the board also need to grow to keep up with the company’s emerging realities. Specific action plans should include addressing weaknesses and redundancies by closing competency gaps through development, refreshment practices and succession planning. Progress on the action plan needs to be tracked and reported, and subsequent evaluation cycles need to be scheduled annually.

Don’t Leave Yourself in the Dark

Boards are becoming more transparent in response to shareholder engagement and activism, and a critical consideration is whether or not the expertise and skills represented by directors are aligned with company strategy and investor value creation. As a result, more and more company boards are disclosing composition in the form of board skills matrices. Although we may never know what a human capital assessment of Blockbuster may have surfaced, implementing rigorous and repeated evaluation practices into your own board will help assure you are keeping pace with the needs of the organization.